Assessing the Role of Insurance Telematics in Auto Leasing: Betbhai9 com sign up, Radheexchange, Lotus 365.io

betbhai9 com sign up, radheexchange, lotus 365.io: Assessing the Role of Insurance Telematics in Auto Leasing

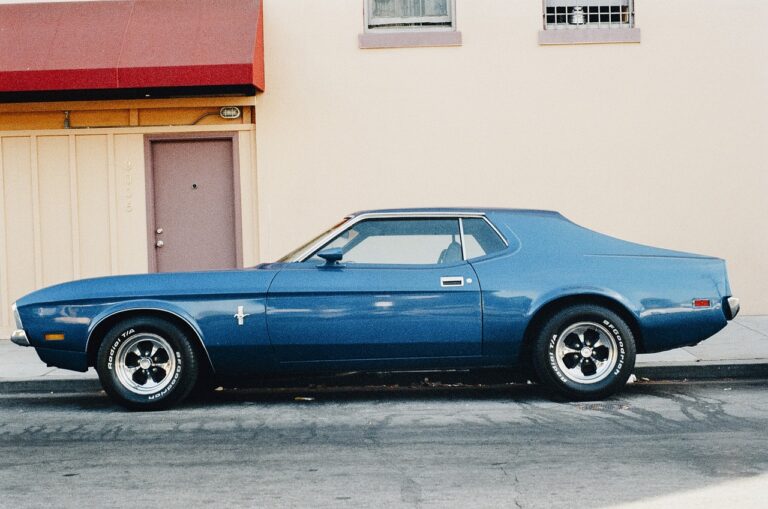

In recent years, the use of telematics in the insurance industry has seen a significant rise. Telematics, which involves the use of GPS technology and sensors to monitor driving behavior, has proven to be valuable in improving road safety and reducing insurance costs. While telematics has primarily been used in personal auto insurance, its role in auto leasing is also gaining traction.

Auto leasing has become a popular option for individuals who want to drive a new car without the long-term commitment of ownership. However, leasing companies face unique challenges when it comes to insurance. Insurance premiums for leased vehicles are typically higher than for owned vehicles, as leasing companies are responsible for insuring their entire fleet of vehicles. This is where insurance telematics can play a crucial role.

By collecting data on leased vehicles’ driving behaviors, such as speed, acceleration, braking, and cornering, insurance telematics can help leasing companies assess risk more accurately. This data can be used to determine insurance premiums based on individual driver behavior, rather than relying on traditional factors such as age, gender, and location. This personalized approach to insurance pricing can result in lower premiums for safer drivers, incentivizing responsible driving among lessees.

Furthermore, insurance telematics can help leasing companies identify high-risk drivers within their fleet and take proactive measures to improve road safety. By providing real-time feedback on driving behavior, telematics devices can encourage drivers to adopt safer habits behind the wheel. This can lead to fewer accidents, lower insurance claims, and ultimately, reduced costs for leasing companies.

In addition to improving road safety and reducing insurance costs, insurance telematics can also benefit lessees. By opting for a telematics-based insurance policy, lessees can take control of their insurance premiums and potentially save money by driving safely. This can be especially appealing for younger drivers and those with limited driving experience, who may face higher insurance costs due to their age or lack of driving history.

Overall, insurance telematics has the potential to revolutionize the auto leasing industry by making insurance more personalized, affordable, and effective in managing risk. By leveraging telematics technology, leasing companies can optimize their insurance operations, improve road safety, and enhance the overall leasing experience for their customers.

FAQs

1. What is insurance telematics?

Insurance telematics is a technology that involves the use of GPS tracking and sensors to monitor driving behavior. This data is used by insurance companies to assess risk and determine insurance premiums based on individual driver behavior.

2. How can insurance telematics benefit leasing companies?

Insurance telematics can help leasing companies assess risk more accurately, reduce insurance costs, improve road safety, and provide personalized insurance pricing for their customers.

3. Are telematics-based insurance policies more expensive?

Telematics-based insurance policies can be more affordable for safer drivers, as premiums are based on individual driving behavior rather than traditional factors such as age, gender, and location.

4. How can drivers benefit from insurance telematics?

Drivers can potentially save money on their insurance premiums by driving safely and adopting good driving habits. Telematics devices provide real-time feedback on driving behavior, encouraging drivers to be more responsible behind the wheel.